In today’s rapidly evolving job market, employee expectations are shifting dramatically across many industries. Sectors like IT, finance, and even some areas of professional services have already begun to adapt, with firms offering flexible working arrangements, remote work options, and even four-day working weeks. In contrast, the insolvency sector often lags behind, clinging to traditional work practices that not only limit employee satisfaction but also hinder the ability to attract and retain top talent.

The Shift in Work Culture: A Comparison with IT

In the IT sector, there’s been a strong movement towards flexible work arrangements, including four-day working weeks. This change is driven by several factors:

- Employee Demand for Flexibility: Many IT professionals value work-life balance and are prioritising it over traditional job perks. They seek employers who offer flexibility in terms of hours and location, allowing them to maintain a better balance between work and personal life.

- Increased Productivity: Numerous studies have shown that shorter workweeks can actually boost productivity. In the IT sector, where output is often measured by project completion rather than hours logged, a four-day week can mean more focused and efficient work periods.

- Competitive Advantage in Recruitment: Firms that offer modern work arrangements, including reduced hours, find it easier to attract top talent. Conversely, companies that insist on traditional five-day office-based workweeks struggle to fill positions, resulting in critical skill shortages that affect their bottom line.

- Employee Well-Being and Retention: The shift towards shorter workweeks and greater flexibility has also been linked to improved mental health, reduced burnout, and higher job satisfaction—all factors that contribute to higher retention rates.

The Insolvency Sector’s Traditional Model

The insolvency sector, however, often remains rooted in conventional work patterns. Long hours, inflexible schedules, and the expectation that staff must be constantly available are still prevalent. This approach presents several challenges:

- Difficulty Attracting Young Talent: Younger professionals, especially those from generations that prioritise work-life balance, often find the insolvency sector unappealing as it doesn’t offer the flexibility they see in other industries.

- Increased Risk of Burnout: The intense workload and long hours expected in many insolvency firms can quickly lead to burnout, especially among partners and senior staff who are already stretched thin managing complex cases and business development responsibilities.

- Struggles with Staff Retention: Without the draw of modern work practices, insolvency firms face higher turnover rates. The costs associated with training new hires and the loss of knowledge can be significant, further compounding operational challenges.

- Regulatory Pressures: Insolvency firms are also under pressure from regulators to maintain high standards of case management and compliance. The added workload from these demands can overwhelm staff who are already working at capacity, leading to costly errors and regulatory risks.

The Need for a Paradigm Shift

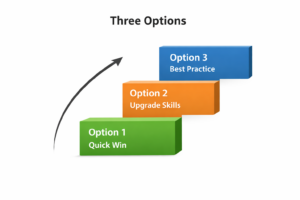

To compete with other sectors and attract high-calibre staff, insolvency firms must rethink their approach to work. This is where adopting AI technologies, such as VAi, can be transformative:

- Reducing Workload with AI: By integrating AI into daily operations, insolvency firms can significantly reduce the manual workload that staff face. AI tools can handle routine tasks, manage case documentation, and provide instant guidance on compliance issues, freeing up time for staff to focus on more strategic and fulfilling aspects of their roles.

- Enabling Flexible Work Arrangements: With AI taking on a substantial share of the administrative burden, firms can offer more flexible work arrangements, including the possibility of a four-day working week. This flexibility can make the insolvency sector more attractive to potential recruits and retain current employees.

- Improving Work-Life Balance: By using AI to streamline workflows and reduce the need for long hours, insolvency firms can help their staff achieve a better work-life balance. This not only improves job satisfaction but also reduces burnout and turnover, making the firm more resilient in the long term.

- Maintaining High Standards with Reduced Hours: AI can ensure that quality and compliance standards are met consistently, even as firms experiment with shorter workweeks. For example, VAi can ensure that all regulatory requirements are addressed and alert staff to any issues that need human intervention.

The Competitive Advantage of Modernising Work Practices

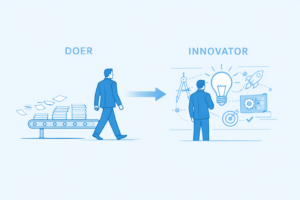

Insolvency firms that fail to modernise their work practices will fall behind. As other sectors continue to embrace flexibility, those clinging to outdated models will struggle to compete for talent. The use of AI, like VAi, is not just about improving efficiency – it’s about rethinking how work is done, enabling firms to offer the kind of employment conditions that today’s professionals expect.

If your employer hasn’t equipped you with the right tools to do your job to the best of your ability, it may be a sign that they either don’t care or are stuck with the wrong business model. By not embracing modern solutions like AI, firms are forcing staff and partners to overextend themselves, leading to burnout and a decline in the quality of work.

The bottom line is clear: by not using AI, you’re missing out on an opportunity to revolutionise your practice, better support your team, and safeguard the future of your firm. It’s time to embrace change, adopt the best technologies, and redefine what it means to work in the insolvency sector.

The reality is simple: if your insolvency firm isn’t using AI to drive better work practices, you’re not only missing out on operational efficiencies but also risking the well-being and retention of your most valuable asset – your people. It’s time to embrace change, adopt the best technologies, and redefine what it means to work in the insolvency sector.