In 1996, Andrew Grove published ‘Only the Paranoid Survive’ at a pivotal moment for global business: the dawn of the internet era. Grove’s insights into ‘strategic inflection points’ – times when external forces fundamentally reshape industries – were prescient then and are still vital today. His message was clear: companies that don’t embrace major shifts risk becoming obsolete. For insolvency practitioners facing the rise of artificial intelligence (‘AI’), Grove’s insights are a timely reminder that adaptation is essential.

The rapid advancements in AI have the potential to transform insolvency work, just as the internet reshaped entire industries in the 90s. While many firms hesitate, questioning if AI truly applies to their work, Grove’s warning is clear: those who resist these changes risk being outpaced by competitors who see the value in automation, efficiency, and enhanced client service.

The Internet’s Lessons from 1995-1996: A Time of Transformation

The mid-90s introduced the internet as a business force, forever changing how companies operate. The launch of Netscape’s browser, the rise of e-commerce giants like Amazon, and the introduction of web-based email through Hotmail all demonstrated the internet’s potential. Businesses could now reach global customers in seconds, streamline communication, and even revolutionise their core business models. Companies that ignored this inflection point, such as Kodak, Blockbuster, and Borders, suffered greatly.

Companies That Ignored the Internet and Suffered:

- Kodak: Though Kodak invented the digital camera, it was slow to adopt digital photography, fearing it would erode its film business. As online photo sharing grew, Kodak failed to adapt, ultimately filing for bankruptcy in 2012.

- Blockbuster: Despite its early dominance, Blockbuster underestimated streaming and digital rentals, failing to adapt as Netflix and other streaming services captured the market. Blockbuster’s last stores closed in 2013.

- Borders: By outsourcing online sales to Amazon in 2001, Borders downplayed the importance of e-commerce, believing traditional retail would continue to dominate. This strategic misstep led to Borders’ bankruptcy in 2011.

For insolvency practitioners, the lesson is clear. Like the internet, AI represents a strategic inflection point that can redefine the industry. Embracing AI can enable firms to improve efficiency, enhance client service, and ensure future competitiveness. For firms ready to innovate, this is a moment of vast opportunity. For those who resist, the risks may be equally profound.

AI in Insolvency: A Path to Efficiency, Enhanced Service, and Staff Wellbeing

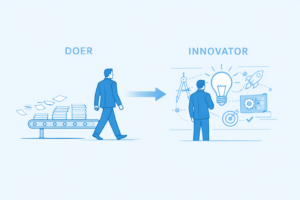

AI offers insolvency firms the ability to streamline operations and automate repetitive tasks, freeing staff to focus on high-value work and strategic advisory services. The benefits go beyond productivity – providing employees with modern tools supports a healthier work-life balance and reduces job stress. This is especially critical in a people-driven business, where the quality of staff wellbeing directly impacts the quality of client service.

Key Benefits of AI in Insolvency:

- Automated Document Generation: AI tools can quickly produce emails, templates for reports, client updates, file notes, and communications, reducing time spent on repetitive work.

- Data-Driven Insights for Client Advice: AI can analyse client financials and offer insights at unprecedented speed, supporting more accurate, proactive advisory.

- Consistent Case Management: AI-enabled platforms can manage compliance, deadlines, and task tracking, creating a more efficient and organised operation.

- Enhanced Client Communication: AI can automate routine client updates, answer frequently asked questions, and provide immediate information, improving the client experience.

For employees, access to modern tools means they can focus on meaningful, complex work rather than repetitive tasks. Ignoring the importance of these tools is a critical mistake; it not only limits firm efficiency but also risks employee dissatisfaction and turnover. A people-focused business thrives when its team is supported with the best resources, and AI can provide the support needed for a more balanced, fulfilling work environment.

The Critical Role of Tools for Staff Wellbeing and Retention

In insolvency, the firm’s people are its greatest asset. Equipping employees with efficient, AI-driven tools allows them to manage workloads effectively, which benefits their mental health, job satisfaction, and overall engagement. Firms that resist modernisation may inadvertently increase stress and frustration for their teams, while those that invest in supportive tools help prevent burnout and boost retention.

Benefits of AI for Employee Wellbeing:

- Reduced Administrative Burden: By automating routine tasks, AI frees up staff for more engaging, high-value work.

- Improved Work-Life Balance: Efficient tools reduce the need for overtime, supporting a healthier work-life balance.

- Increased Job Satisfaction: Access to the latest tools allows employees to focus on meaningful work, which enhances job satisfaction and fosters loyalty.

- Attracting and Retaining Talent: Modern, innovative firms are more attractive to new hires and have lower turnover, creating a stable, committed team.

By meeting the needs of their staff, insolvency firms can improve both employee engagement and client service. Ignoring this is a critical mistake in a people-focused business. Investing in technology to support the team is one of the most impactful steps a firm can take for sustainable success.

Rethinking Billing Models: From Hours to Value

Insolvency firms have long relied on hourly billing, but AI presents an opportunity to reconsider this model. As AI-driven automation reduces the time needed for routine tasks, firms have an opportunity to transition to value-based billing, where fees reflect the results delivered rather than hours worked. Grove’s insight on adapting business models is directly applicable here. Value-based billing aligns with client expectations and rewards the firm’s efficiencies rather than penalising them with lower billable hours.

Benefits of Value-Based Billing:

- Enhanced Client Satisfaction: Clients prefer transparent, outcome-based fees, which align with their expectations and foster trust.

- Incentive for Efficiency: Value-based billing enables firms to capture the financial benefits of increased efficiency rather than seeing reduced revenue from shorter billing hours.

- Differentiation in a Traditional Industry: Firms that offer value-based pricing distinguish themselves from competitors, appealing to clients seeking predictable and transparent pricing.

Resisting this shift limits the benefits of AI and may even signal an outdated approach to clients. Adopting a value-based billing model aligns with Grove’s advice to adapt to meet market needs – a critical factor in successfully navigating inflection points.

Preparing for Succession: Building a Future-Ready Firm

For insolvency practitioners nearing retirement, now is the time to build a future-ready firm. Grove’s insights show that companies that resist change become less attractive to buyers and potential successors. A firm that embraces AI and adopts modern processes signals profitability, stability, and innovation – all of which increase its appeal to future leaders.

Why a Modernised Practice is More Attractive for Succession:

- Lower Operating Costs and Improved Margins: AI reduces operational costs, increasing profitability and boosting attractiveness to buyers.

- Scalability for Growth: AI-driven processes allow firms to handle more cases with the same resources, appealing to investors.

- Appeal to Younger Professionals: Modern, tech-enabled firms attract and retain younger talent, ensuring continuity and supporting succession.

- Enhanced Client Reputation: Firms that use AI to improve client service gain a reputation for reliability and quality, making them more valuable on the market.

By adopting AI now, insolvency firms can improve their market value, future-proof operations, and build a stronger succession strategy. Grove’s insights make it clear: those who embrace change during inflection points secure their legacy, while those who resist may struggle to find buyers or new leadership.

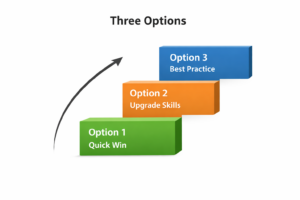

Practical Steps for Embracing the Inflection Point

For insolvency practitioners ready to act on this inflection point, Grove’s guidance offers a roadmap:

- Conduct a Technology Audit: Evaluate current processes and identify areas where AI can improve efficiency, especially in repetitive or administrative tasks.

- Experiment with AI Tools: Start small with AI applications like document and advice generation or automated client communication to assess their impact on workflows.

- Pilot Value-Based Billing: Trial value-based pricing models to align with the efficiencies gained from AI and meet modern client preferences.

- Invest in Training and Support: Equip staff to use new tools confidently, ensuring they feel supported in adapting to AI-driven processes.

- Cultivate a Culture of Innovation: Encourage adaptability, reward innovation, and create a workplace culture that prioritises efficiency, client satisfaction, and employee wellbeing.

Conclusion: A Moment to Reflect and Act

Grove’s insights remind us that companies facing inflection points cannot afford to remain complacent. In a world increasingly shaped by AI, insolvency practitioners have a choice: embrace this transformation, or risk falling behind competitors who do. Embracing AI can improve client service, support team wellbeing, and ensure a firm’s relevance for years to come.

So, here’s a critical question for today’s insolvency practitioners:

If you were fired today, what would a new MD of your firm do?

So let’s do it!

In Grove’s words, ‘There’s at least as much risk in ‘letting things stay the same’ as there is in ‘taking action.’ For insolvency practitioners, the time to act is now.