Ethan Mollick, in his book Co-Intelligence: Living and Working with AI – by the wway a book we wholeheartedly recommend to you – offers a compelling challenge:

“You should try inviting AI to help you in everything you do, barring legal or ethical barriers. As you experiment, you may find that AI help can be satisfying, or frustrating, or useless, or unnerving. But you aren’t just doing this for help alone; familiarizing yourself with AI’s capabilities allows you to better understand how it can assist you – or threaten you and your job.”

At first glance, that last phrase might set alarm bells ringing for insolvency practitioners. Is AI a helpful assistant, or is it about to replace us? Will it streamline our workload, or will we soon find it drafting statutory reports faster than we can? The answer, as with most things in insolvency, is: it depends.

The Insolvency Industry’s Problem

Insolvency practice is an industry built on precision, compliance, and sound judgment. Yet, it is also an industry bogged down by paperwork, regulation-heavy processes, and time-consuming client interactions.

For decades, the tools of the trade have been case management systems, spreadsheets, and – let’s be honest – a great deal of patience. Every report, statement of affairs, and creditor correspondence takes time. Every compliance check is another demand on an already stretched team.

With caseloads increasing, insolvency practitioners are expected to be more efficient than ever. The real challenge? Doing that while maintaining the highest standards of accuracy and professional integrity.

How We Used to Solve This Problem

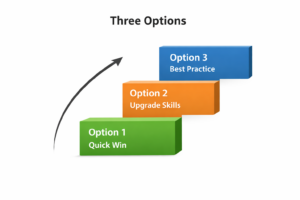

Before AI, efficiency in insolvency relied on:

- Hiring more staff (costly and not always viable).

- Implementing better case management software (helpful but still requiring manual input).

- Streamlining workflows through better training and delegation.

- Burning the midnight oil and just working harder (not exactly a long-term strategy).

While these approaches have helped, they haven’t addressed the fundamental issue: insolvency practice involves a mountain of repetitive, structured tasks that eat into time that could be better spent on strategic problem-solving and client relationships.

Enter AI: A Game-Changer for Insolvency

Now, let’s take Mollick’s advice and invite AI into the insolvency world. What happens?

- Faster Document Production – AI can draft reports, emails, and legal documents in seconds. Our very own VAi can generate a wide range of written work and suggest improvements and case strategies – all at the click of a button.

- More Efficient Case Analysis – AI can review financial statements, flag irregularities, and summarise key points, saving hours of manual review.

- Smarter Client Interaction – Chatbots and AI-driven email responses can handle routine creditor and potential new work provider queries, freeing up professionals for more complex work.

- Compliance and Risk Management – AI can cross-check documents against legal requirements, reducing errors and ensuring compliance is watertight.

- Better Decision Support – AI can highlight trends, risks, and potential pitfalls in cases, giving insolvency practitioners a sharper strategic edge.

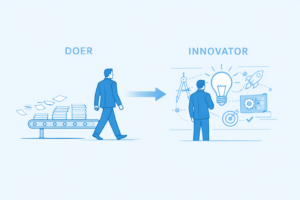

The AI Challenge: Will You Experiment or Be Left Behind?

Mollick’s words pose an uncomfortable but necessary question: if AI can help, but we choose not to use it, are we making the best business decision?

Yes, AI can be frustrating at times. It can make mistakes, misunderstand context, and always requires human oversight. But so do junior staff – and we invest in training them. AI is no different; it just learns faster, a lot faster.

The real threat isn’t AI taking over insolvency work. It’s insolvency firms that do embrace AI moving so far ahead in efficiency that those who don’t will struggle to compete.

So, here’s the challenge: will you experiment with AI, test its capabilities, and refine its role in your practice? Or will you wait and see, risking obsolescence in an industry that is already under pressure?

If you’re curious about how AI – specifically VAI – can transform your practice, give me, Paul, a call or drop him an email. Let’s explore the future together.