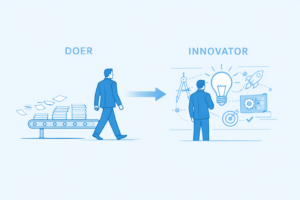

In the rapidly evolving landscape of digital technology, all businesses – yes even insolvency practitioners – must constantly seek innovative solutions to streamline operations, enhance productivity, and drive growth if they are to compete. One such innovation that has gained traction in recent years is the use of artificial intelligence (AI) in various applications, including client-lead assessment tools and, far more recently, generative AI-powered platforms like VAi. While both serve the purpose of assisting potential clients in different ways, there are significant differences in their capabilities, flexibility, and overall usefulness. In this article, we’ll delve into the distinctions between client-lead assessment tools and VAi, highlighting the unique advantages that VAi brings to the table.

Understanding Client-Lead Assessment Tools

Client-lead assessment tools are commonly used by businesses like insolvency practices to qualify potential leads, capture potential client contact information, and tailor marketing strategies. These tools typically rely on predefined, rigid, criteria and algorithms to analyse data input by the potential client in order to generate recommendations. While they can be effective for standardised assessments and structured evaluations, they often lack the flexibility and adaptability required for more complex or dynamic situations.

Introducing VAi: The Power of Generative AI

VAi stands apart from traditional client-lead assessment tools by harnessing the capabilities of generative AI, a sophisticated technology that goes far beyond predefined rules and criteria. Unlike static assessment tools, VAi has the ability to generate dynamic, context-aware responses based on the specific needs and inputs of potential clients. This enables VAi to adapt to a wide range of scenarios and provide personalised insights and recommendations, and in the form preferred by the potential client, and it does this all in real-time.

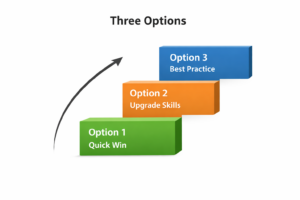

Key Differences and Advantages of VAi Over Client-Lead Assessment Tools

1. Flexibility and Adaptability:

– Client-lead assessment tools are often rigid and limited by predefined parameters, making them less adaptable to unique or evolving customer interactions.

– In contrast, VAi is highly flexible and can dynamically adjust its responses based on changing circumstances, ensuring relevance and accuracy in diverse scenarios.

2. Personalisation and Customisation:

– Client-lead assessment tools typically follow a one-size-fits-all approach, providing, at best, generic assessments and recommendations and, at worst, merely act as a lead filter for the website operator (in this case the insolvency practitioner), providing nothing that the user – who is looking for advice and information – can work with.

– VAi, on the other hand, offers personalised interactions and tailored insights, catering to the individual circumstances, needs and preferences of users. This personalised approach enhances engagement and effectiveness, leading to far more meaningful outputs and outcomes.

3. Creativity and Innovation:

– While client-lead assessment tools focus on analysing existing data and patterns, they often lack the capacity for creative problem-solving and innovation.

– VAi leverages generative AI to generate novel ideas, solutions, and perspectives, fostering a culture of creativity and innovation. This enables VAi to tackle complex user questions in innovative ways.

4. Real-Time Responsiveness:

– Client-lead assessment tools typically require users to input more data later on in the process and wait for the system – or real people – to generate results or recommendations.

– VAi delivers real-time responses and insights, allowing users to receive immediate feedback and guidance, enhancing efficiency and decision-making in dynamic customer interactions.

5. Client Education:

– Client-lead assessment tools require additional time from the insolvency practitioner and staff to educate potential clients on the technical, practical and other aspects of their situation before they feel confident in making a decision.

– VAi empowers potential clients with knowledge of processes, pros, and cons, enabling them to make informed decisions more efficiently, thus reducing the need for the insolvency practitioner or his staff spending time on extensive education sessions.

Conclusion

Client-lead assessment tools, though still relevant, will soon become less common and relevant due to their limited sophistication, flexibility, personalisation, and creativity compared to generative AI tools like VAi. VAi is poised to replace these outdated tools, much like how advancements in technology have made the horse-drawn plough, abacus, typewriter, film camera, and fax machine obsolete as users gravitated towards more sophisticated, innovative, and quicker solutions.