There is a part of the sea that sailors fear, not because it’s violent, but because it’s quiet.

The Doldrums.

Not a storm. Not a crisis. Just… no wind.

The sails hang limp. The sun beats down. The crew keep doing ‘work’, but nothing moves. Days pass. Water runs low. Morale drops. And the most dangerous thing is this: from the deck, it can look like you are still doing your job. You are afloat. You are ‘busy’. You are not sinking.

But you are not going anywhere.

That is where a chunk of the insolvency profession is drifting right now.

The profession is on the edge

If you are an insolvency practitioner who is not adopting AI, you are on the edge of the Doldrums whether you realise it or not.

Because the wind has changed.

Clients have changed. Creditors have changed. Regulators have changed. Courts have changed. Expectations have changed. The volume and velocity of information has changed. The complexity of casework has increased. The scrutiny has increased. The availability of good staff has decreased. The tolerance for delay has evaporated.

And the economics, for many firms, are being squeezed from both sides:

- Pressure to keep fees acceptable, even when work has become heavier.

- Pressure to produce more documentation, more compliance evidence, more reporting detail.

- Pressure to respond faster, explain more clearly, and leave less room for error.

You can carry on as you are. For a little while. That is the uncomfortable truth.

But the other truth is that the window is not generous.

“But we are coping”

This is the most common self-deception in professional services.

“We’re coping.”

In the Doldrums you also feel like you’re coping. The boat is not sinking. Everyone is doing something. You might even be working harder than ever.

The problem is not effort. The problem is motion.

AI is not a shiny toy. In insolvency, it is becoming a propulsion system for the firms that understand how to use it properly.

And yes, I said properly. With safeguards. With a human in the loop. With data controls. With professional judgement firmly at the centre.

But still, propulsion.

What changes when a rival firm adopts AI first

Here’s what happens when another firm adopts AI with intent, not dabbling:

- They draft faster: routine letters, first-cut reports, meeting notes, case updates, chase emails, creditor FAQs.

- They standardise better: templates become consistent, tone becomes consistent, compliance narrative becomes consistent.

- They think clearer under pressure: AI becomes a second brain for structuring complex issues, spotting missing questions, stress-testing a plan.

- They train juniors faster: not by replacing learning, but by accelerating it, with better examples and better explanations.

- They respond quicker to stakeholders: directors, lenders, lawyers, employees. Speed becomes a service feature.

- They reduce rework: fewer “start again” moments because the initial output is structured and closer to final.

- They create capacity: the same headcount handles more cases, or handles cases with more care.

That last point is the killer.

Capacity wins.

Capacity lets you take the better cases, service them better, and still breathe. Capacity lets you invest in marketing, systems, and people. Capacity lets you say no to the marginal work that drains the team.

Meanwhile, the non-adopting firm is proud of being thorough while quietly becoming uncompetitive.

The dangerous myth: “AI is risky so we should avoid it”

AI does introduce risk. So does email. So does Excel. So does delegating to an inexperienced team member. So does working tired.

Avoiding AI does not remove risk. It often increases it, because you are forced to run a high-complexity, high-documentation workload through a human machine that is already overloaded.

The grown-up approach is this:

- Define what AI can and cannot be used for.

- Build simple guardrails.

- Keep humans accountable for judgement calls.

- Use AI for structure, drafting, summarising, checklists, pattern spotting, and consistency.

- Do not use it to “decide”. Use it to help you decide.

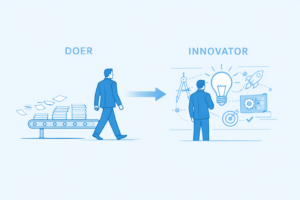

If you are an IP, your value is judgement, ethics, prioritisation, risk management, negotiation, and the ability to steer competing interests to an outcome.

AI should be doing more of the grind so you can do more of the judgement.

A blunt prediction

I’ll put it plainly.

In the next couple of years, many IPs who do not adopt AI will find themselves:

- working longer hours to stand still,

- struggling to recruit and retain talent who expect modern tooling,

- losing introducer confidence because response times lag,

- producing less consistent outputs because everyone is stretched,

- becoming less profitable, not because they are greedy, but because the cost base is fixed and the workload is ballooning,

- and ultimately becoming unattractive as a firm to join, buy, merge with, or refer to.

Dead in the water.

Not because they are bad practitioners. Often the opposite. Because they are good people doing heavy work, using yesterday’s toolkit, in tomorrow’s environment (well, arguably, today’s environment!).

You have a little time. But not much.

This is the edge of the Doldrums moment.

You still have time to catch the wind if you move now.

But the firms that are already adapting will not wait for you. They will move faster than you. They will build better systems. They will test, learn, refine, and compound their advantage.

And compound advantage in professional services is brutal.

Once a firm becomes known for speed, clarity, and consistency, referrals follow. Better work follows. Better people follow.

That is the wind.

What adoption actually looks like for an IP firm

It is not a grand transformation programme. It is a sequence of practical moves.

- Choose the pain first

Start where your team groans. Meeting notes. First drafts. Standard letters. Directors’ FAQs. File note structure. Case progression summaries. Initial information gathering. - Build a small prompt library

Five to ten prompts that produce consistent first drafts in your house style. Not “write a report”. More like “draft the statutory narrative for X, based on these facts, using our tone, with these headings.” - Put the human in the loop on purpose

AI drafts. Humans review and sign off. Make that explicit. It keeps quality high and keeps responsibility where it belongs. - Create rules for data and confidentiality

If your answer involves confidential data, your policy must be clear. If you are using a specialist tool, ensure it is configured correctly. If you are using general tools, use redaction and anonymisation by default. - Measure time saved, not novelty

If you save 15 minutes a day, that is more than an hour a week, per person. Across a small team, that is serious capacity. - Train the team properly

Not a one-hour demo. Practical sessions. Real outputs. Real examples. Real feedback. Regularly.

The profession does not need AI. It needs augmented professionals.

This matters.

The goal is not to automate insolvency. The goal is to augment insolvency practitioners so that:

- judgement improves because thinking time increases,

- documentation improves because structure improves,

- consistency improves because templates improve,

- client experience improves because communication improves,

- wellbeing improves because pressure reduces.

That is a better profession.

And it is more defensible, more ethical, and more sustainable.

Final thought: stillness is a decision

If you are reading this and feeling a bit uncomfortable, good.

That discomfort is a signal.

The Doldrums are not a punishment. They are a warning that the environment has changed and your old assumptions no longer move you forward.

Do not wait until the water runs low.

Catch the wind now.

Hashtags

#Insolvency #InsolvencyPractitioner #AI #ProfessionalServices #BusinessRecovery #Turnaround #PracticeManagement #Compliance #Productivity #LegalTech #Ethics #HumanInTheLoop