What Side of the Line Are You On. And Will You Still Be Employable Next Year?

The ground beneath the accountancy profession is shifting fast. The arrival of AI into mainstream practice isn’t just a technological change, it’s a reordering of what value looks like, how firms are run, and who stays employable.

So let’s ask the question head-on:

- Are you avoiding AI altogether?

- Are you using AI tools – but only to drive efficiency?

- Or are you embracing AI as a way to build new opportunities, services and career resilience?

Where you sit today – avoidance, efficiency, or opportunity – might just define your career or firm’s future.

A sector under new ownership

Accountancy has become a private equity (PE) feeding frenzy.

- Cinven completed a landmark £1.5 billion investment in Grant Thornton UK in early 2025 — the biggest PE-backed accountancy deal in UK history.

- PE-backed Azets continues aggressive roll-ups, with support from Hg Capital.

- Xeinadin, now operating across 130 UK & Irish offices, is backed by Exponent and growing via consolidation of smaller firms into a tech-led model.

- BK Plus, founded only in 2021, has grown rapidly through acquisition, positioning itself as a tech-first challenger, acquiring firms and blending technology with traditional services.

The deal logic behind these acquisitions is clear: these aren’t sentimental investments in partnerships, they are bets on scalable, tech-enabled platforms.

And here’s the catch…

PE doesn’t just want efficiencies.

It wants growth, leverage, new services, and new tools.

That means firms, and everyone in them, must perform more, deliver better, and innovate faster.

No one is exempt

Let’s not pretend otherwise:

AI is not just replacing junior admin work. It is already eating into all levels of accountancy work , from bookkeeping to forecasting, report writing to restructuring options analysis, management accounts to marketing, and from compliance to strategy.

Partners, owners, and senior managers aren’t safe either – in fact, AI might challenges the senior, more experienced people the most… because this is the first technology revolution that isn’t just about automating the lower ranks, it disrupts experienced staff too.

- AI can already generate strategy reports, simulate tax implications, draft engagement letters, model turnaround scenarios, and summarise insolvency options.

- It can produce content, marketing, and business development material better and faster than most firm owners can manage unaided.

- With the rise of copilots like VAi, even insolvency-specific guidance is now being generated in seconds.

Case in point: The 6-Lens Review™

If you want a real example of where this is all heading, look no further than the 6-Lens Review™ developed by my firm, Midlands Business Recovery.

This isn’t a junior tool that just automates admin. It’s a high-level diagnostic engine, powered by AI and built from the insights of some of the most respected names in UK insolvency and restructuring.

It replicates the thinking and experience of six distinct expert lenses:

- The Strategist

- The Turnaround Expert

- The Litigator

- The Technician

- The Empath

- The Innovator

In other words, it does the type of work that normally takes the most experienced team members days, even weeks, to produce.

It pulls together strategy options, flags legal risks, suggests rescue paths, and even challenges poor advice already given. And it does it at a fraction of the cost of employing a panel of experts.

This is not just AI-enabled practice.

This is what AI-first looks like.

Read more in the latest blog: “The Team You Never Had”.

The junior question: what makes you valuable now?

To junior staff – in both general and insolvency practices – this should be a wake-up call.

You are already expected to do more, faster, and with better outputs.

Your firm is likely under PE pressure – or will be competing against those that are.

If you’re a junior in your firm, here’s what you should be asking yourself right now:

- Can I do my job better with AI?

- Do I understand how AI can reduce my errors and increase my speed?

- Can I bring AI tools into conversations at work, not just follow instructions?

- Am I adding value by being an early adopter – not just waiting to be told?

Because here’s the truth:

AI literacy will become a baseline employability skill. Just like Excel was. Just like email was.

And if you don’t learn it now? You’ll be passed over by someone who did, because they will be able to do your job, cheaper, faster, better.

The insolvency staff dilemma: why your job is changing too

For those in insolvency firms, it’s easy to think ‘this doesn’t apply to us.’ After all, the work is complex, often human-driven, and case-specific.

But that’s already changing.

- AI tools can assemble file notes, review director conduct, summarise documents, suggest creditor responses, and draft progress reports.

- VAi already supports junior and senior staff by helping them reason through SIP requirements, CVL notices, and initial strategy formation – all in seconds.

- And now, with the 6-Lens Review™, even the most complex advisory outputs are part-automated, streamlined, and auditable.

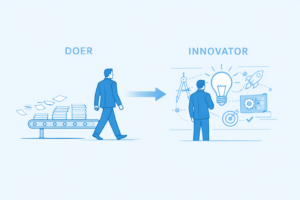

You are no longer employed just for what you know, but how fast and how well you can use what AI knows.

And here’s a deeper question you should be asking:

‘If I’m working in an insolvency firm that isn’t embracing AI or automation – is this really the right place for me?’

‘Could staying here be harming my medium- to long-term employability?’

‘Would I be better off in a forward-moving – not just forward-looking – firm that’s actually doing something about AI?’

Because if your firm is standing still, while competitors are investing in AI-first tools like VAi and the 6-Lens Review™, you may be training yourself into redundancy, not relevance.

Here’s another thought for you…

If your firms isn’t embracing ai, aren’t you sacrificing the quality of your life for your bosses’ lack of vision, indeed arguably, incompetence?

AI-first is coming

Firms aren’t just going to be ‘AI-enabled’ anymore – where you bolt tools on.

The new firm model – especially the ones PE is building – is AI-first:

- Tech comes first. Then workflows are built around it.

- People are expected to work in tandem with AI from the start, not separately.

- Productivity expectations will rise. Clients will expect faster, cheaper, smarter.

Efficiency alone won’t be enough.

Being a passive user of AI won’t be enough either.

You’ll need to co-create with AI.

To challenge it, prompt it, instruct it.

And to deliver better outputs than those who just click buttons.

Don’t expect a guarantee

Let’s be blunt. There’s no such thing as a secure career anymore – not in accounting.

There hasn’t been for a while. But going forward, there’ll be even less.

- PE investors will reshape firms faster than partnerships ever did.

- Salary reviews, redundancies, and promotions will be based more on output, not time served.

- And the person sitting beside you who knows how to wield AI might get ahead faster – even if they know less technical detail than you., because it’s all about the value you bring and the cost you bring it at.

An ai-empowered employee that does the work of 3, quicker and at one third of the cost, even if they make the occasional mistake (‘hallucination’) is far more employable than a time served employee – however loyal they are to the firm – who sticks to old ways of working. Speaking bluntly, loyalty counts for nothing, output in relation to cost is all that matters.

10 questions to ask yourself now

Whether you’re a trainee, manager, or partner, you may want to ask yourself these questions:

- Are you actively avoiding AI because it scares you or because you haven’t had time?

- Do you know how AI can be used ethically and compliantly in your firm?

- Are you using AI to create just efficiencies, or new client value?

- Have you tried experimenting with tools like VAi, ChatGPT, Copilot for Excel, or MBR’s 6-Lens Review?

- Could you summarise a client meeting or restructure a memo faster with AI?

- Are your juniors already using AI behind the scenes, and outpacing you?

- Do your clients expect faster turnaround times than your firm currently delivers?

- Are you actively learning AI, or hoping someone else will tell you what to do?

- Have you used AI to simulate alternative insolvency outcomes or model tax impacts?

- Most importantly:

Is your firm investing in the tools, skills, and systems needed to stay relevant? Or are you stuck in a place that’s falling behind and quietly dragging your career with it?

Would you be more employable five years from now if you moved to a firm that’s actually doing, not just talking about, AI and automation?

If the answer to that last one unsettles you, then that’s your signal to act.

Final thought

Avoid AI and risk obsolescence.

Use AI just for efficiency, and risk stagnation.

Use AI for opportunity and you build resilience, relevance and growth.

Whether your firm is already PE-owned, under acquisition pressure, or just trying to stay competitive, the expectations are rising.

And if your current firm isn’t embracing that change, here’s a blunt but necessary challenge:

Are you building a career in a firm that’s preparing for the future or clinging to the past?

And if it’s the latter, what’s that doing to your future?

Firms like Midlands Business Recovery are already leading with tools like VAi and the 6-Lens Review™ – platforms that automate high-level thinking, not just admin.

If your employer isn’t exploring tools like these, perhaps it’s time that you did.

So the only question left to ask is:

Where do you sit?

Avoidance, efficiency, or opportunity?