Recently, a VAi user entered the prompt “MVL” into the AI system. That’s it. Nothing more, nothing less (well, it’s hard to see how there could be any less!).

MVL stands for Members’ Voluntary Liquidation, a process relevant to company insolvency. the brvity of the ‘prompt’ suggests to me that the user was either trying to see what VAi could do with the barest of information or see if he could break it. No problem either way, we encourage anyone to do so!

Let’s compare how helpful VAi’s response was compared to the typical process of using Google to find similar information.

Here’s the response, word for word, provided by VAi to the query “MVL”, copied from my daily report:

‘A Members Voluntary Liquidation (MVL), often simply referred to as an MVL, is a process in which a solvent company voluntarily chooses to wind up its affairs and cease to trade. This process is typically driven by the company’s shareholders and is often implemented when a company is no longer needed, or if it is part of a restructuring process. Here are some key features:

- Solvent company: The company should be able to repay its outstanding debts within 12 months from the commencement of liquidation.

- Shareholder’s decision: The decision to undergo an MVL is often taken by the company’s shareholders with a majority vote.

- Liquidator: An Insolvency Practitioner is appointed as a liquidator to oversee the process of liquidation, which includes dealing with company assets and creditor claims.

- Asset distribution: Any surplus assets, after repaying creditors and covering liquidation costs, are distributed amongst the shareholders relative to their shareholdings.

- Tax efficiency: MVLs can be quite tax-efficient for the shareholders. They may qualify for Business Asset Disposal Relief (formerly known as Entrepreneurs’ Relief), which can reduce the capital gains tax payable on distributions.

- Legality: This process is formal and legal, set out in Part IV of the Insolvency Act 1986, principally sections 89, 90, 91, and 94.

While an MVL can be a beneficial strategy under certain circumstances, it demands detailed planning considering all its legal and financial implications. Therefore, professional advice from an accredited insolvency practitioner or your accountant or lawyer is highly recommended before proceeding with an MVL.

That’s a brief overview. Do you want more information on any specific aspect of the MVL process?‘

Now let’s compare that to a Google search…

Using Google to Find Information on ‘MVL’

When using Google to search for “MVL,” a user must sift through various search results to find relevant and accurate information. Here’s a step-by-step breakdown of what this process looks like:

- Enter Search Term: The user types “MVL” into the Google search bar.

- Review Search Results: The search results will likely include links to various websites such as government pages, legal and insolvency firms, accounting blogs, and articles. The user must sift through the links which seem most relevant.

- Visit Multiple Pages: To gather comprehensive information, the user needs to visit a number of separate websites, in turn. For example, one page might explain the basic concept of an MVL, another might detail the legal requirements, and another might cover the tax implications.

- Evaluate Credibility: The user must determine the credibility and reliability of each source, which can be time-consuming and confusing, especially for those unfamiliar with the subject and sources.

- Compile Information: The user then needs to compile and synthesise the information from various sources to get an understanding of the MVL process. Whether that understanding is complete remains to be seen.

So let’s compare the two, entirely different, processes…

Comparing VAi to Google

VAi Advantages:

- Comprehensive and Concise: VAi provides a detailed yet succinct explanation of MVL, covering key aspects such as the process, legalities, and tax implications in one response.

- Time-Efficient: Users receive immediate, relevant information without having to sift through multiple web pages.

- User-Friendly: VAi’s response is tailored to the user’s query, offering a personalised touch that general search engines cannot match.

- Interactive: VAi invites follow-up questions, allowing users to delve deeper into specific aspects of the MVL process.

Google Search Process:

- Multiple Steps: Users need to review and filter through several search results to find relevant information.

- Time-Consuming: Compiling and verifying information from various sources can be time-consuming.

- Variable Quality: The quality and reliability of information can vary significantly across different websites.

- Non-Interactive: Google does not provide the interactive, conversational feedback that VAi offers, making it harder to get specific follow-up information quickly.

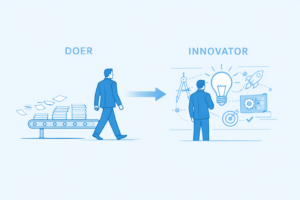

Conclusion

While Google is an incredibly powerful tool for finding information, VAi provides a far more streamlined and user-friendly experience. This is because generative ai is better than Google for dealing with complex topics, like insolvency. VAi’s ability to offer comprehensive, reliable, and immediate responses tailored to the user’s needs highlights the advantages of generative AI-powered solutions in providing specialised advice.

For those dealing with intricate insolvency matters, VAi stands out as a valuable resource, saving time and effort while delivering high-quality, personalised insights.

Explore the benefits of VAi today and experience the future of insolvency support at your fingertips.