If you’ve been in practice a while, you will remember a book called Who Moved My Cheese? – the fable about change that was in the briefcase of every professional who was serious about their career. It’s still a little gem and painfully relevant to the professions – including the insolvency profession – today. You can skim the plot on Wikipedia here: Who Moved My Cheese?. Better yet, buy a copy and give it half an hour of honest attention. It will repay you.

This blog is a challenge to fellow IPs. Over the last two years or so I’ve heard variations of the same line again and again: ‘AI won’t touch what we do… I’ll retire before it matters.’ Meanwhile, fees are questioned, trust is thin outside our bubble, staff are stretched, and younger talent looks elsewhere because the old model of 50+ hour weeks doing work that software should be doing is not attractive to them. That’s the cheese moving. And many IPs are standing still.

VAi – my insolvency co-pilot – exists precisely because the maze has changed. It helps directors and their advisers make better, faster decisions, with a human firmly in the loop. Below I’ll show how. But first, a quick refresher on the cheese.

A Short Summary: Who Moved My Cheese?

- The Maze & The Cheese: The maze is the world of work; the cheese is what we want (success, fees, reputation, fulfilment).

- Four Mice Characters:

- Sniff (senses change early)

- Scurry (acts quickly)

- Hem (denies and resists)

- Haw (hesitates, but eventually adapts)

- What happens: The cheese runs out at Station C. Sniff and Scurry immediately go looking elsewhere. Hem complains and stays put. Haw wrestles with fear, then laughs at himself, moves on, and finds new cheese. Along the way he writes messages on the wall:

- “If you do not change, you can become extinct.”

- “What would you do if you weren’t afraid?”

- “Smell the cheese often so you know when it is getting old.”

- “The quicker you let go of old cheese, the sooner you find new cheese.”

- The point: Change happens. Anticipate it, monitor it, adapt to it, enjoy it, and be ready to do it again.

It’s simple. It’s also the professional reality we’re in.

The Insolvency Profession’s ‘Old Cheese’

Let’s be candid.

- “People will always want to deal with people.” True. They want to deal with good people, augmented by technology that respects their time and intelligence. Gen Z (and a lot of Millennials and Gen X, frankly) grew up with Amazon-speed, search-first service, and 24/7 chat. If our onboarding, letters, and case updates feel like the 1980s, we’ve already lost the first impression.

- Trust is fragile. Outside the profession, many assume they’ll get incomplete advice and high fees. Some of that is unfair; some of it we’ve earned with bloated paperwork that doesn’t answer the director’s real questions. Trust is rebuilt by clarity, speed, and evidence – every single touchpoint.

- “I’m not prepared to spend the time learning it.” That sentence is a staffing strategy. If the firm won’t invest in tools and learning, staff end up doing the worst bits of the job longer – more manual review, more repetitive drafting, more re-keying – leading to burnout and low job satisfaction. The result? Fewer people who want to become tomorrow’s IPs (or take on your business when you plan to retire).

- Hours that don’t make sense anymore. IPs and their staff routinely work 50+ hour weeks because their process choices make it so. You could run a thriving practice on a 4-day, 30-hour week if you deliberately redesign the work with AI as standard. If that sounds fanciful, ask: which tasks genuinely require an expert brain, and which are high-quality pattern work we insist on doing the slow way?

The cheese has moved. Pretending it hasn’t is Hem’s choice. We need more Haw.

“But AI isn’t relevant to insolvency.” It already is.

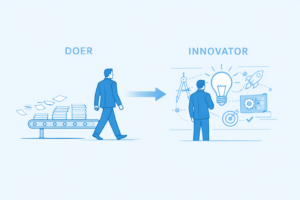

I built VAi, which is still the UK’s only insolvency co-pilot that uses generative ai, because I was not prepared to waste my very valuable time (or that of my staff) on tasks that a well-trained system could do in seconds – with me checking and guiding. Importantly:

- VAi is not a replacement for an IP. It does not run AML and it does not ‘own’ your case strategy.

- It is a force multiplier. You stay in control; it handles the heavy lifting, drafts, repurposes, and produces first- and second-pass (and third + if you want it) analysis so you can spend your limited hours on important judgement calls.

Here’s what that looks like in practice.

Practical Ways VAi Changes the Day-to-Day (with a Human in the Loop)

1) Faster, clearer client communication (that builds trust)

- Situation: A director emails at 5:41 pm, Wednesday: “Are we personally on the hook for X? What happens to the lease? What about staff?”

- Without VAi: Someone drafts a careful reply from scratch tomorrow, or worse, lets it slip to Friday.

- With VAi: You feed in the email you’ve received, plus any other company specific information that’s relevant, and how you want the tone to be; VAi produces a plain-English reply with correct signposting, caveats, and next steps – aligned to UK practice. You review in two minutes. You either like it and send it or you ask VAi to further personalise the tone, then send.

- Result: Anxiety down, trust up, time saved.

2) Tight, SIP-compliant drafting at speed

- Examples:

- SIP 6 Reports – Shortened, relevant to the reader – while still compliant – wording that demonstrates clarity of thinking and purpose.

- SIP 3-aligned initial options memo for directors, tailored to their facts.

- SIP 9 fee narrative: clear scope, benefit to creditors, time-cost justification – without the fluff.

- Short, consistent creditor updates that cut jargon and answer the actual questions.

- Your role: You set the tone and length, you check legal accuracy, add case nuance, and approve.

- Outcome: Better quality in less time, and a paper trail that actually persuades.

3) Investigation planning you can act on

- VAi can generate structured work plans for director transactions, connected-party dealings, DLA points, and potential antecedent transactions – organised by risk priority.

- You decide what lines of enquiry to pursue and what to drop. You repurpose inputs and outputs eg plan – letters / emails – results assessment – file notes production.

- Benefit: Staff stop reinventing the wheel; you get consistent coverage and fewer misses.

4) Case workflows

- Initial timelines and set workflows who does what by when built around your process for that case.

- Your control: You edit and better control the workflow.

5) Director education, once – then forever

- Create a bank of explainers (what a CVL really involves, what happens to guarantees, how claims are adjudicated) in friendly English.

- VAi tailors the tone to the recipient (accountant, director, creditor).

- Result: Fewer repetitive emails / conversations, better-informed decisions, less suspicion.

6) House style and quality control

- VAi applies your voice so letters, reports and emails feel like you, not a generic insolvency case system produced filler.

- You remain the editor-in-chief. The machine is your best junior who never gets tired of version control.

“What would you do if you weren’t afraid?”- Moving to a 4-Day Week

Let’s name the fear: If we cut hours, quality will drop and revenue will fall.

It doesn’t have to.

- Use VAi to strip out the low-value time: first drafts, repetition ‘by hand’ of facts in different places, production of better than standard letters, better than template reports, better research.

- Redeploy your best people to the true insolvency practitioner work: judgement, negotiation, coaching directors through hard choices, relationship management, and stitching together better outcomes. And don’t forget, no IP knows it all, I guarantee VAi will throw up things you will never have thought about, you and your staff will be stretched in a good way, they’ll enjoy working with it, it will become their best friend.

- Pilot a 30-hour week for one team for one quarter. Track: quality, turnaround times, director feedback, WIP recovery, and staff wellbeing.

- Expect the paradox: Higher energy + better focus often means more throughput in fewer hours – because you’re spending time where it counts.

Staff who feel trusted, tooled up, and trained give their best work. Those asked to power through outdated process, don’t.

Rebuilding Credibility Outside the Profession

People don’t distrust us because we’re IPs; they distrust what feels opaque, slow, and expensive. VAi helps us fix that:

- Clarity: Shorter, sharper explanations.

- Speed: Same-day answers to anxious questions.

- Evidence: Clear articulation of the benefit of each piece of work (especially on fees).

- Consistency: Fewer errors and fewer “Sorry, that letter went yesterday” moments.

If you want to repair reputation, start here.

“Smell the cheese often”- The Generational Reality

Gen Z doesn’t “try to call reception” first. They search, scan, and self-serve; then they want a knowledgeable human to decide with them. AI isn’t de-humanising our work; it’s re-humanising it by clearing the dull stuff out of the way so your judgement actually shows up.

If your firm feels allergic to tools your clients use every day, you’re signalling “not for you – or for them” without meaning to. VAi lets you meet clients in the mode they’re already in – fast, clear, respectful – and then bring them into the relationship you want: human, ethical, outcome-focused.

“The quicker you let go of old cheese, the sooner you find new cheese.”

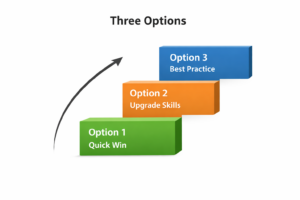

Concrete VAi Use-Cases You Can Start This Month

- Director Decision Pack (same day):

- VAi drafts an options memo (CVL/MVL/administration/informal) with pros, cons, costs, timelines, and director-specific FAQs. Complaince with the ICAEW’s new ethics guide.

- You set the tone, edit, add judgement, send.

- Outcome: Directors stop dithering; cases move.

- Fee Narrative That Lands:

- VAi structures SIP 9 narrative around benefits delivered, not time spent.

- You validate and tweak the wording.

- Outcome: Fewer challenges, more understanding, better creditor sentiment.

- ROT & Supplier Engagement Checklist:

- VAi generates a clear checklist for engaging with ROT claimants and suppliers.

- You apply the case facts; staff follow consistently.

- Outcome: Less friction, fewer mistakes, quicker resolutions.

- Creditor Update Template Bank:

- VAi keeps updates short, focused on “what changed and why it matters.”

- You approve; the team uses and later re-uses.

- Outcome: Trust builds over time.

- Investigation Heat-Map:

- VAi ingests a timeline and flags obvious enquiry lines (DLAs, connected parties, preferences, transactions at undervalue).

- You prioritise; juniors execute.

- Outcome: Better coverage with fewer blind spots.

Guardrails: VAi doesn’t do AML; it doesn’t replace your judgement; and it doesn’t “own” strategy. It’s your co-pilot – the human stays in the loop.

“What’s my first step if my team is sceptical?”

- Pick one case.

- Pick two or three pain points (e.g., director FAQs and SIP 9 narrative).

- Time-box a pilot (two weeks).

- Measure: hours saved, turnaround, number of follow-up questions, internal stress levels.

- Share wins internally and let the team propose the next few use-cases. Adoption sticks when people feel the benefit themselves.

If you truly believe there’s no time to learn it, that’s the first indicator you really need it.

The Invitation (and the Nudge)

- Revisit the fable: Who Moved My Cheese?. Buy the book; it’s inexpensive and still right on the money.

- Decide which character you’re going to be this quarter – Hem, or Haw.

- Book a short VAi walkthrough for you and your senior team. I’ll show you how to save hours a week, reduce burnout, and lift quality at the same time – without losing control or professional integrity.

Final thought: Our sector says “people will always want to deal with people.” I agree – people who make their lives easier, tell them the truth quickly, and respect their time. That’s what AI, used properly, enables. The cheese has moved. Let’s move with it.